Investing your hard-earned money can be a powerful way to grow your wealth, but deciding where to start can feel overwhelming. Two of the most popular investment options today are cryptocurrencies and traditional stocks. Both have the potential to help you achieve your financial goals, but they come with different risks, rewards, and strategies. In this blog, we’ll compare crypto and stocks in simple terms to help you decide which one is right for you.

What Are Traditional Stocks?

Traditional stocks represent ownership in a company. When you buy a stock, you own a small piece of that company, called a share. Companies sell stocks to raise money, and in return, investors like you can benefit when the company grows and becomes more valuable. Stocks are traded on regulated markets like the New York Stock Exchange (NYSE) or Nasdaq.

Here’s how you can earn money with stocks:

- Capital Gains: Selling stocks for a higher price than you paid.

- Dividends: Some companies share profits with stockholders in the form of dividends.

What Is Cryptocurrency?

Cryptocurrency, or crypto, is digital money powered by blockchain technology. Instead of physical cash or traditional banks, crypto operates on a decentralized network. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). These digital assets are traded on platforms called crypto exchanges, such as Binance or Coinbase.

Here’s how you can earn money with crypto:

- Price Appreciation: Buying low and selling high, similar to stocks.

- Staking or Yield Farming: Earning rewards by holding or lending your crypto.

- Mining: Using computing power to validate blockchain transactions and earn crypto.

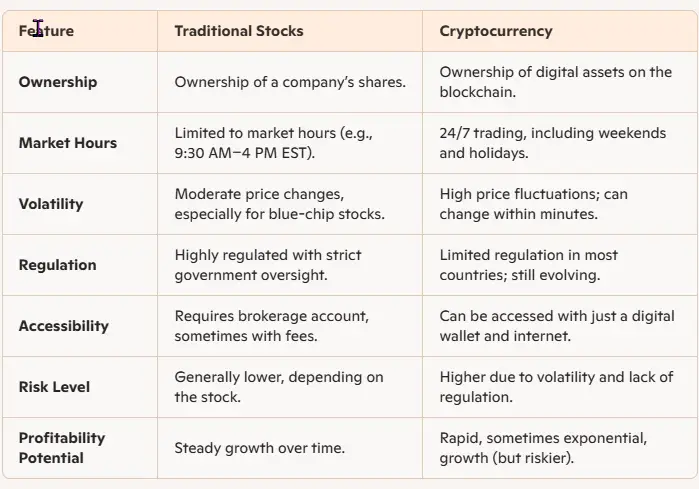

Comparing Crypto and Stocks

To help you understand the key differences and similarities, let’s break it down:

| Feature | Traditional Stocks | Cryptocurrency |

|---|---|---|

| Ownership | Ownership of a company’s shares. | Ownership of digital assets on the blockchain. |

| Market Hours | Limited to market hours (e.g., 9:30 AM–4 PM EST). | 24/7 trading, including weekends and holidays. |

| Volatility | Moderate price changes, especially for blue-chip stocks. | High price fluctuations; can change within minutes. |

| Regulation | Highly regulated with strict government oversight. | Limited regulation in most countries; still evolving. |

| Accessibility | Requires brokerage account, sometimes with fees. | Can be accessed with just a digital wallet and internet. |

| Risk Level | Generally lower, depending on the stock. | Higher due to volatility and lack of regulation. |

| Profitability Potential | Steady growth over time. | Rapid, sometimes exponential growth (but riskier). |

Benefits of Investing in Stocks

Stocks have been a trusted investment option for decades. Here’s why many people choose them:

- Stability: Especially with well-established companies, stocks provide steady growth.

- Dividends: Earn a passive income stream if the company pays dividends.

- Less Volatility: Stocks generally experience fewer dramatic price swings compared to crypto.

- Long-Term Growth: Historically, stock markets like the S&P 500 have shown consistent growth over time.

Benefits of Investing in Cryptocurrency

Crypto is gaining popularity for its unique advantages:

- High Growth Potential: Some cryptocurrencies, like Bitcoin, have skyrocketed in value.

- Decentralization: No middlemen or banks, giving you direct control of your assets.

- 24/7 Access: Trade anytime, anywhere without being limited by market hours.

- Innovation: Crypto represents cutting-edge technology and financial systems.

Which Is Right for Your Financial Goals?

The choice between crypto and traditional stocks depends on your financial goals, risk tolerance, and investment strategy. Let’s look at some scenarios:

If You Want Stability:

Stocks may be a better option. They’re less volatile, easier to predict, and backed by established companies. Long-term investors might prefer investing in blue-chip stocks or index funds.

If You Want High Growth:

Cryptocurrencies are known for their explosive growth. However, the same potential for high returns comes with higher risks. If you’re comfortable with volatility and are willing to do your research, crypto could be a good choice.

If You Want Diversification:

Why not both? Diversifying your portfolio by investing in both stocks and crypto can help balance risk. Stocks provide stability, while crypto offers high-risk, high-reward opportunities.

If You’re New to Investing:

Start small. Invest in stocks to build a foundation while learning about crypto on the side. Platforms like Web3Wonders.US can guide beginners on the basics of crypto and blockchain.

Risks to Consider

While both stocks and crypto have potential, they come with risks:

- Stock Risks: Market downturns, company-specific problems, and economic changes can affect stock prices.

- Crypto Risks: Price volatility, hacking, and regulatory uncertainties make crypto riskier

Understanding these risks and investing only what you can afford to lose is key.

How to Get Started

- Set Your Goals: Define what you want to achieve—growth, passive income, or diversification.

- Research Platforms: For stocks, explore brokers like Robinhood or Fidelity. For crypto, look into exchanges like Coinbase or Binance.

- Start Small: Don’t dive in with your life savings. Invest small amounts to test the waters.

- Learn Continuously: Follow trusted resources like Web3Wonders.US for guides, tips, and trends.

Final Thoughts

Investing in stocks or crypto doesn’t have to be an either-or decision. Both have unique benefits and challenges, and the best choice depends on your goals and risk tolerance. Whether you’re leaning toward stable growth with stocks or exploring the high-growth potential of crypto, it’s never been easier to start.

Are you ready to begin your investment journey? Subscribe to Web3Wonders.US today for beginner-friendly guides, insights, and tips to help you navigate the world of Web3 and beyond. Join a community of learners and investors who are shaping their financial futures!

Disclaimer: The information in this blog is for educational purposes only and does not constitute financial advice. Investing in Traditional Finance and Web 3 assets, including cryptocurrencies and precious metals, involves significant risks, including the potential loss of principal. Always conduct your own research and consult a qualified financial advisor and/or tax advisor before making investment decisions. Past performance is not indicative of future results.

Heard about 8888vi from another player. Seems like a solid platform. Gotta give it a shot to be sure, but first impressions are good. Why not visit them here 8888vi?

Goinbet7 is decent, has got a fair range of casino options and sports. Nothing amazing, but solid and trustworthy enough. Have a look yeah? Find it here: goinbet7

Need a reliable link for 188bet? linkvao188betmoinhat is the answer. Always up-to-date links and safe to use. A total life saver. Get your linkvao188betmoinhat here!

Yo, 84win219! Just signed up, and the site is smooth. Deposits were quick, and the game selection is solid. Hoping for some big wins, but even if not, seems like a legit place to have some fun. Check them out here: 84win219

Yo, phpopularcasino is alright! Got a decent selection of games and the site’s pretty easy to navigate. Feels like a good place to chill and try your luck. Check it out at phpopularcasino

Alright, 007jl…slick interface, and some interesting options. Definitely worth checking out if you’re hunting for something new. Grab a look here: 007jl

QQ88OKVIP sounds like a VIP experience and I need that. Going to test out their support, and then deposit. Check it out for yourself: qq88okvip