The world of finance is changing rapidly, and Decentralized Finance, or DeFi, is at the heart of this transformation. Powered by blockchain technology, DeFi offers an innovative way for people to borrow, lend, and invest without relying on traditional banks or financial institutions. In this blog, we’ll break down what DeFi is, how it works, and why it’s considered the future of loans and investments. Plus, we’ll compare DeFi to traditional finance (TradFi) to make these concepts easy to understand.

What Is DeFi?

Decentralized Finance, or DeFi, refers to a financial system built on blockchain technology that operates without intermediaries like banks or brokers. Instead, DeFi uses smart contracts—self-executing contracts with rules encoded into them—to facilitate transactions.

Here’s how DeFi works:

- Smart Contracts: Automated agreements that execute when conditions are met.

- Blockchain: A decentralized ledger that records transactions transparently.

- Tokens: Cryptocurrencies or digital assets used within the system.

DeFi applications, often called “dApps” (decentralized apps), let users perform financial tasks like borrowing, lending, or earning interest in a decentralized way.

Key Features of DeFi

DeFi brings several unique features that set it apart from traditional finance:

- No Middlemen: Transactions occur directly between users through smart contracts.

- Global Access: Anyone with an internet connection can use DeFi, regardless of location.

- Transparency: All transactions are recorded on a public blockchain.

- 24/7 Availability: DeFi operates around the clock, unlike banks with fixed hours.

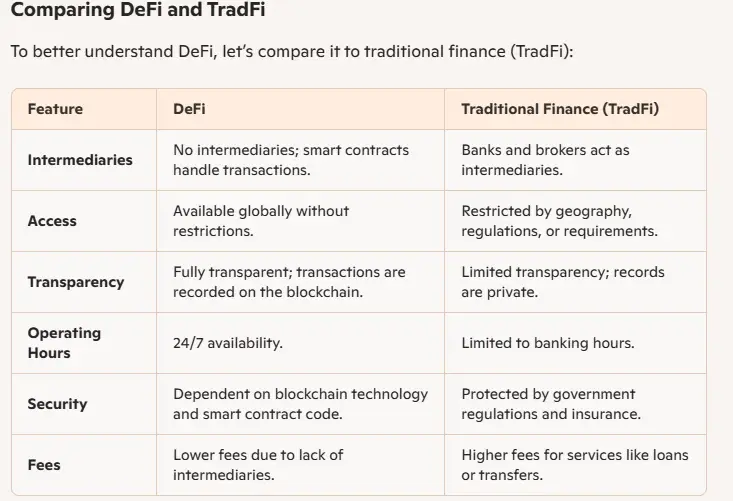

Comparing DeFi and TradFi

To better understand DeFi, let’s compare it to traditional finance (TradFi):

| Feature | DeFi | Traditional Finance (TradFi) |

|---|---|---|

| Intermediaries | No intermediaries; smart contracts handle transactions. | Banks and brokers act as intermediaries. |

| Access | Available globally without restrictions. | Restricted by geography, regulations, or requirements. |

| Transparency | Fully transparent; transactions are recorded on the blockchain. | Limited transparency; records are private. |

| Operating Hours | 24/7 availability. | Limited to banking hours. |

| Security | Dependent on blockchain technology and smart contract code. | Protected by government regulations and insurance. |

| Fees | Lower fees due to lack of intermediaries. | Higher fees for services like loans or transfers. |

How DeFi Loans Work

DeFi makes borrowing and lending easier and faster than ever before. Here’s how a typical DeFi loan works:

- Collateral: Borrowers deposit cryptocurrency as collateral to secure the loan.

- Smart Contract: The loan terms are encoded into a smart contract.

- Loan Execution: Once the collateral is locked, the smart contract releases the loan amount.

- Repayment: Borrowers repay the loan with interest, and the collateral is returned.

Unlike traditional loans, DeFi loans are instant, do not require credit checks, and can be accessed by anyone, anywhere.

How DeFi Investments Work

DeFi also opens up new opportunities for investments:

- Yield Farming: Earn rewards by providing liquidity to DeFi platforms.

- Staking: Lock your crypto assets to support blockchain operations and earn interest.

- Tokenized Assets: Invest in fractional ownership of real-world assets like real estate.

These investment methods offer higher returns compared to traditional savings or investment accounts, but they come with higher risks.

Benefits of DeFi

- Accessibility: DeFi removes barriers to entry, allowing anyone with internet access to participate.

- Efficiency: Transactions are faster and cheaper than traditional finance.

- Control: Users have full control over their assets without relying on banks.

- Innovation: DeFi introduces new financial tools and opportunities.

Risks of DeFi

While DeFi offers exciting possibilities, it’s not without risks:

- Smart Contract Vulnerabilities: Bugs in code can be exploited by hackers.

- Market Volatility: Cryptocurrencies can experience rapid price changes.

- Regulatory Uncertainty: DeFi operates in a largely unregulated environment.

- Scams: As a relatively new space, DeFi is a target for fraudsters.

It’s important to research platforms and understand the risks before diving into DeFi.

Similarities to TradFi

While DeFi is innovative, it still has some similarities to traditional finance:

- Lending and Borrowing: Like banks, DeFi platforms let users borrow and lend assets.

- Risk Management: Just as with stocks or bonds, understanding risks is critical in DeFi.

- Growth Opportunities: Both systems offer ways to grow wealth, whether through interest, dividends, or staking rewards.

Why DeFi Is the Future

DeFi is revolutionizing the way we think about money. By eliminating intermediaries and offering global access, DeFi has the potential to democratize finance and create opportunities for millions of people. As the technology matures, it’s likely to become an essential part of the financial ecosystem.

Call to Action: Stay Ahead with Web3Wonders

Are you ready to explore the future of finance? At Web3Wonders.US, we make complex Web3 topics like DeFi easy to understand. Whether you’re a beginner or an experienced investor, our guides and resources will help you navigate the world of blockchain and decentralized finance.

Subscribe now to join a community of learners and get exclusive tips, updates, and insights delivered straight to your inbox. Don’t miss the chance to stay ahead in the ever-evolving world of DeFi!

Disclaimer: The information in this blog is for educational purposes only and does not constitute financial advice. Investing in Traditional Finance and Web 3 assets, including cryptocurrencies and precious metals, involves significant risks, including the potential loss of principal. Always conduct your own research and consult a qualified financial advisor and/or tax advisor before making investment decisions. Past performance is not indicative of future results.

Betmaster Casino, huh? Casino options keep popping up! Hope this one’s not a dud. Worth a look here: betmastercasino

F8bet05…another betting site, I reckon. Need to see what their odds are like, and if they actually pay out. Worth a look: f8bet05

Local777 is my go-to spot! Always a great time playing their games. Good customer service too. Give them a look! local777.

Win777 Casino has a decent selection of slots and live games. I’ve had some luck there, but remember to play responsibly! Just another option to consider. Check them out at: win777casino

SuperKingPH is pretty solid. I like the variety of games they have. The payouts are decent too, haven’t had any issues so far. Give it a shot superkingph.

Gameaviatorbet – that Aviator game is addictive! Simple but fun, and you can win some decent money if you’re smart. They are only offering aviator: gameaviatorbet

How’s it hangin’, everyone? Gave fb88tivi a go. Good stuff, alright. Streamlined and easy to navigate. Might be your new favourite spot! Have a peek: fb88tivi