Are you looking for new ways to grow your investment portfolio? Maybe you’ve been investing in stocks, bonds, or real estate in the traditional financial (TradFi) world. But have you thought about blockchain assets? Blockchain technology is revolutionizing how people invest, offering exciting opportunities for diversification. This blog will explain blockchain investing, compare it to TradFi investing, and help you take your first steps toward portfolio diversification.

What Are Blockchain Assets?

Blockchain assets are digital assets powered by blockchain technology. You might have heard of cryptocurrencies like Bitcoin or Ethereum. But blockchain investing isn’t just about crypto. It includes:

- Cryptocurrencies: Digital coins like Bitcoin (BTC), Cardano (ADA), Ripple (XRP) or Ethereum (ETH).

- Stablecoins: Cryptocurrencies tied to real-world assets like the US dollar.

- NFTs: Non-fungible tokens representing unique digital or physical items.

- DeFi Tokens: Tokens used in decentralized finance platforms.

- Tokenized Real Estate: Shares of physical properties sold on blockchain.

Each type of asset is unique and offers its own benefits. Just like stocks and bonds in TradFi, blockchain assets give you options for diversification.

Why Diversify with Blockchain Assets?

Diversifying your portfolio is key to managing risk and maximizing returns. Here’s why blockchain assets make sense for diversification:

- New Market Opportunities: Blockchain assets are independent from traditional markets like stocks or bonds. They can perform well even when TradFi markets are down.

- High Growth Potential: Cryptocurrencies and NFTs can grow quickly in value.

- Global Reach: Blockchain technology connects people worldwide. This global network opens doors to investments you couldn’t access otherwise.

- Innovative Technology: Blockchain introduces new ways to invest, like tokenized assets and DeFi platforms.

Similarities Between TradFi and Blockchain Investing

Blockchain investing might seem mysterious, but it shares many similarities with TradFi investing. Let’s compare:

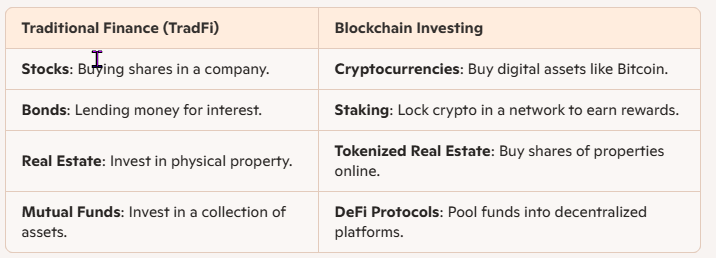

| Traditional Finance (TradFi) | Blockchain Investing |

|---|---|

| Stocks: Buying shares in a company. | Cryptocurrencies: Buy digital assets like Bitcoin. |

| Bonds: Lending money for interest. | Staking: Lock crypto in a network to earn rewards. |

| Real Estate: Invest in physical property. | Tokenized Real Estate: Buy shares of properties online. |

| Mutual Funds: Invest in a collection of assets. | DeFi Protocols: Pool funds into decentralized platforms. |

Blockchain investing uses concepts you already know. For example, staking crypto is similar to earning interest on a bond. Diversifying with tokenized real estate feels like investing in traditional real estate. This connection helps make blockchain investing easier to understand.

Steps to Diversify with Blockchain Assets

Ready to explore blockchain investing? Follow these beginner-friendly steps:

1. Educate Yourself

Understand how blockchain assets work. Learn about cryptocurrencies, DeFi, and NFTs. Plenty of guides and glossaries (like those at Web3Wonders.US) can help.

2. Start Small

Don’t invest all your money in blockchain assets at once. Begin with a small amount to test the waters.

3. Choose the Right Assets

Select blockchain assets that match your goals. For example:

- If you want stability, choose stable coins.

- If you want high growth, try cryptocurrencies.

- If you’re creative, explore NFTs.

4. Use Trusted Platforms

Make sure you’re using reputable exchanges like Binance, Coinbase, or Kraken. These platforms are safe for beginners.

5. Manage Risk

Blockchain assets can be volatile. Diversify across different asset types to minimize risk.

6. Stay Updated

Blockchain technology is always evolving. Keep learning to stay ahead in this fast-moving field.

Challenges of Blockchain Investing

Like any investment, blockchain assets come with risks:

- Volatility: Prices can rise or fall quickly.

- Security Risks: Cybersecurity is important to protect your investments.

- Complexity: Blockchain technology can be hard to understand at first.

Despite these challenges, blockchain investing is becoming more accessible. Beginners can use friendly platforms, tools, and educational resources like Web3Wonders.US to learn more.

Why Learn Blockchain Investing Now?

Blockchain is transforming the financial world. With more people investing in crypto and DeFi, now is the perfect time to learn. Early adopters have the chance to grow their portfolios and embrace cutting-edge technology.

Call to Action

Are you ready to take the next step? At Web3Wonders.US, we make blockchain easy for beginners. From glossaries to detailed guides, we offer everything you need to start investing confidently. Visit us today and subscribe for free tips, updates, and resources. Let’s explore the world of blockchain investing together!

Disclaimer: The information in this blog is for educational purposes only and does not constitute financial advice. Investing in Traditional Finance and Web 3 assets, including cryptocurrencies and precious metals, involves significant risks, including the potential loss of principal. Always conduct your own research and consult a qualified financial advisor and/or tax advisor before making investment decisions. Past performance is not indicative of future results.

Hi Binance, Thank you so much for stopping by. I enjoy the ads and articles I see from Binance. GREATLY appreciate it, Kelly

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

LocoCasino lives up to the name! Some crazy fun to be had here. Give it a spin! Here’s the link: lococasino

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/register?ref=IXBIAFVY

88vinchat isn’t bad honestly. I’ve won more than I’ve lost, which is always a plus. Give vinchat a try and see what you think.

Been using Betrupeesapp for a while now. The app is actually pretty decent, loads quickly and easy to navigate. Definitely recommend giving it a look! betrupeesapp

Yo, B9CasinoLogin! Checked you guys out. Site’s pretty slick, easy to navigate, and the games look fire. Hopefully the payouts are just as good, eh? Give it a whirl! b9casinologin

Recently tried out varabet and felt like sharing. Nothing beats a little fun, right? Definitely worth checking out! Check it out guys: varabet

Trying to find a reliable Bong88 agent and found 1gomcombong88. Looks legit. Anyone else using them? Give it a shot: 1gomcombong88

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

55win33, right? Another one to try. Let’s hope the wins are easy to come by! Give it a go with 55win33 see how it works for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/register-person?ref=IHJUI7TF

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.