Investing through iTrustCapital, a platform specializing in self-directed IRAs for cryptocurrencies, precious metals, and alternative assets, demands a strategic approach to both entering and exiting positions. Given the volatility of assets like Bitcoin, Ethereum, gold, and silver, a well-defined exit strategy is crucial to lock in profits, limit losses, and align with long-term financial goals such as retirement planning. Without a clear plan, emotional decisions—panic-selling during dips or holding too long out of greed—can undermine your success.

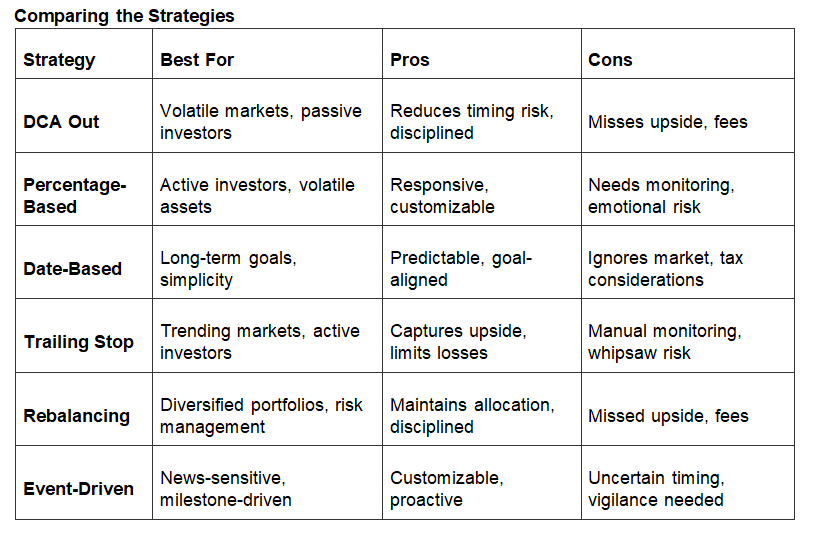

In this comprehensive guide, we explore six effective exit strategies tailored for iTrustCapital users: Dollar-Cost Averaging Out (DCA Out), Percentage-Based Exits, Date-Based Exits, Trailing Stop Exits, Rebalancing Exits, and Event-Driven Exits. Each strategy is detailed with mechanics, advantages, disadvantages, examples, and practical considerations for iTrustCapital’s platform. Whether you’re a seasoned investor or new to IRAs, these strategies will help you navigate volatile markets with confidence.

Why Exit Strategies Matter for iTrustCapital Investors

Exit strategies are predefined plans to liquidate investments, ensuring you realize gains or minimize losses while staying aligned with your objectives. For iTrustCapital users, they are especially critical due to:

- High Volatility: Cryptocurrencies and precious metals can swing dramatically, requiring disciplined exits.

- Tax-Advantaged Accounts: IRAs (Traditional or Roth) offer tax benefits, but withdrawals before age 59½ may incur penalties, necessitating strategic timing.

- Emotional Discipline: Predefined rules reduce impulsive decisions driven by market sentiment.

- Retirement Focus: iTrustCapital’s IRA structure emphasizes long-term wealth, making exit planning essential for distributions.

Let’s dive into the six exit strategies, each tailored to different market conditions, risk tolerances, and goals.

1. Dollar-Cost Averaging Out (DCA Out)

What is DCA Out?

Dollar-Cost Averaging Out (DCA Out) involves selling a fixed amount or percentage of your holdings at regular intervals, regardless of price, to gradually exit a position. This mirrors the DCA entry strategy but in reverse, reducing the risk of selling at a market low while capturing an average selling price.

How It Works

- Assess Your Position: Determine the asset to exit (e.g., 1 Bitcoin or 10 oz of gold).

- Set a Schedule: Choose a frequency (e.g., monthly) and duration (e.g., 12 months).

- Calculate Sales: Divide holdings by intervals (e.g., 0.1 BTC monthly for 10 months).

- Execute: Sell via iTrustCapital’s platform at each interval.

- Monitor (Optional): Adjust if needed, though consistency is key.

Example

You hold 25 Ethereum (ETH) in your iTrustCapital IRA, bought at $2,000 ($50,000 total). In 2025, ETH is $4,000 ($100,000). You sell 2.5 ETH monthly for 10 months:

- Month 1: 2.5 ETH at $4,000 = $10,000

- Month 2: ETH at $3,500 = $8,750

- Month 3: ETH at $4,500 = $11,250

- Outcome: Average selling price of $3,800 yields $95,000, a $45,000 profit.

Advantages

- Reduces timing risk by averaging sale prices.

- Mitigates emotional decisions with a systematic approach.

- Suits volatile assets like crypto and metals.

- Aligns with IRA long-term planning.

Disadvantages

- Misses potential upside if prices keep rising.

- Incurs fees (1% for crypto, $50 + 0.25% per oz for metals).

- Requires discipline to stick to the schedule.

When to Use

- Significant unrealized gains in volatile assets.

- Nearing retirement, shifting to stable assets.

- Uncertain markets where timing is challenging.

2. Percentage-Based Exits

What is a Percentage-Based Exit?

This strategy involves selling part or all of your position when the asset’s price hits specific percentage-based gain or loss thresholds (e.g., +50% or -20%). It’s driven by price performance, making it responsive to market moves.

How It Works

- Set Thresholds: Define gain (e.g., +50%, +100%) and loss (e.g., -20%) targets.

- Monitor Prices: Track via iTrustCapital or external tools.

- Set Alerts: Use third-party apps for price notifications (iTrustCapital lacks automated orders).

- Sell: Execute sales when thresholds are reached.

- Reassess: Adjust remaining thresholds as needed.

Example

You own 100 oz of gold at $2,000/oz ($200,000). Your plan:

- Sell 50% at +50% ($3,000/oz).

- Sell 50% at +100% ($4,000/oz).

- Sell 100% at -20% ($1,600/oz). In 2025, gold hits $3,000; you sell 50 oz for $150,000. If it later reaches $4,000, you sell 50 oz for $200,000, totaling $350,000 ($150,000 profit).

Advantages

- Responsive to market conditions.

- Customizable for gradual or full exits.

- Manages risk with loss thresholds.

- Ideal for volatile assets.

Disadvantages

- Requires active monitoring.

- Premature exits may miss larger gains.

- Emotional triggers from rapid price swings.

When to Use

- Active investors monitoring markets.

- High-volatility assets like Bitcoin.

- Balancing profit-taking and risk.

3. Date-Based Exits

What is a Date-Based Exit?

A date-based exit involves selling on a specific date or after a set holding period, regardless of price, often tied to financial goals like retirement or life events.

How It Works

- Set a Date: Choose a target (e.g., 5 years, age 65).

- Define Scope: Sell all or part of the position.

- Plan Execution: Mark the date and prepare to sell via iTrustCapital.

- Sell: Liquidate on the target date.

- Consider Taxes: Traditional IRA withdrawals are taxed; Roth withdrawals may be tax-free if qualified.

Example

At age 55, you hold 0.5 BTC ($20,000 at $40,000/BTC). You plan to sell at age 60. In 2025, Bitcoin is $60,000; you sell for $30,000, a $10,000 profit, and reinvest in cash for retirement.

Advantages

- Aligns with long-term goals.

- Simple and predictable.

- Reduces market-timing stress.

Disadvantages

- Ignores market conditions, risking sales at lows.

- Limited flexibility if goals change.

- Potential tax implications for withdrawals.

When to Use

- Long-term IRA investors.

- Retirement or milestone-driven plans.

- Investors prioritizing simplicity.

4. Trailing Stop Exits

What is a Trailing Stop Exit?

A trailing stop sets a dynamic sell point that adjusts with the asset’s price, selling if the price falls by a set percentage or amount from its peak. It locks in gains while allowing upside.

How It Works

- Set Trailing Stop: Choose a percentage (e.g., 10%) below the peak.

- Track Prices: Monitor manually or with alerts (iTrustCapital lacks automation).

- Sell: Execute when the price hits the stop.

- Reassess: Reinvest or hold proceeds.

Example

You hold 10 oz of gold at $2,000/oz ($20,000). Gold rises to $3,000; you set a 10% trailing stop ($2,700). If gold drops to $2,700, you sell for $27,000, a $7,000 profit.

Advantages

- Captures upside while protecting gains.

- Flexible with market trends.

- Limits downside risk.

Disadvantages

- Manual monitoring required.

- Whipsaw risk in volatile markets.

- Fees for sales.

When to Use

- Trending markets.

- Active investors.

- Risk-averse traders seeking upside.

5. Rebalancing Exits

What is a Rebalancing Exit?

Rebalancing involves selling over-performing assets to restore your portfolio’s target allocation, maintaining diversification and risk levels.

How It Works

- Set Allocation: Define targets (e.g., 50% crypto, 50% metals).

- Monitor Weights: Check portfolio balance periodically.

- Sell Overweighted Assets: Liquidate to restore targets.

- Reinvest: Allocate proceeds to underweighted assets.

Example

Your $100,000 IRA targets 50% ETH ($50,000) and 50% silver ($50,000). ETH doubles, making your portfolio 67% ETH ($75,000). You sell 3.125 ETH ($12,500) to restore 50/50, locking in gains.

Advantages

- Maintains risk profile.

- Disciplined profit-taking.

- Tax-advantaged in IRAs.

Disadvantages

- Misses upside on winners.

- Incurs fees for multiple trades.

- Requires oversight.

When to Use

- Diversified portfolios.

- Long-term risk management.

- Market imbalances.

6. Event-Driven Exits

What is an Event-Driven Exit?

This strategy triggers sales based on external events, such as regulatory changes, economic shifts, or personal milestones.

How It Works

- Define Triggers: Identify events (e.g., crypto bans, retirement).

- Monitor: Stay informed via news or iTrustCapital’s blog.

- Sell: Execute when the event occurs.

- Reassess: Adjust strategy post-event.

Example

You hold 0.5 BTC at $40,000 ($20,000). You’ll sell if a U.S. crypto ban is proposed. In 2025, such news drops Bitcoin to $50,000; you sell for $25,000, a $5,000 profit.

Advantages

- Customizable to your outlook.

- Proactive risk management.

- Flexible with other strategies.

Disadvantages

- Uncertain timing.

- Requires vigilance.

- Risk of overreacting to news.

When to Use

- News-sensitive investors.

- Milestone-driven goals.

- Volatile, event-heavy markets.

Practical Considerations for iTrustCapital Users

- Platform Limitations: iTrustCapital lacks automated orders (e.g., trailing stops, limit orders), requiring manual monitoring or third-party alerts.

- Fees: Crypto trades cost 1%; precious metals incur $50 + 0.25% per oz. Frequent trades (e.g., rebalancing, trailing stops) increase costs.

- IRA Rules: Traditional IRA withdrawals are taxed as income; Roth withdrawals are tax-free if qualified. Plan exits to avoid penalties before age 59½.

- Volatility: Crypto and metals require strategies that account for sharp price swings.

Conclusion

iTrustCapital investors can choose from six robust exit strategies—DCA Out, Percentage-Based, Date-Based, Trailing Stop, Rebalancing, and Event-Driven—to manage their IRA portfolios effectively. Each caters to different needs:

- DCA Out for gradual exits in volatile markets.

- Percentage-Based for price-driven profit-taking.

- Date-Based for long-term goal alignment.

- Trailing Stop for trending markets.

- Rebalancing for diversification.

- Event-Driven for event-sensitive exits.

Select a strategy based on your risk tolerance, investment horizon, and monitoring capacity. Combining approaches (e.g., rebalancing with event-driven triggers) can enhance flexibility. By planning exits in advance, you’ll navigate the volatility of cryptocurrencies and precious metals, ensuring your IRA supports your financial future.

For personalized guidance or deeper analysis, please consult your financial advisor and tax advisor.

Call to Action: Learn More with Web3Wonders.US

Ready to explore trading automation and tracking tools for technical analysis? At Web3Wonders.US, we provide beginner-friendly guides, strategies, and resources to help TradFi investors succeed in the world of digital assets.

Subscribe now to stay ahead with insights, tips, and updates about trading automation, Web3 tools, and financial planning. Let’s unlock smarter strategies for your investment journey!

Disclaimer: The information in this blog is for educational purposes only and does not constitute financial advice. Investing in Traditional Finance and Web 3 assets, including cryptocurrencies and precious metals, involves significant risks, including the potential loss of principal. Always conduct your own research and consult a qualified financial advisor and/or tax advisor before making investment decisions. Past performance is not indicative of future results.

Guys, I visited 52betwin and I was impressed. Registration was very simple, plus lots of different games! Have fun testing the fun! Check out 52betwin and tell me what you think!

Sup folks! jljl533 looks legit enough. Have a gander at jljl533

Heard some buzz about shambhubet.net, so I checked it out. Looks like another online betting platform, but it’s got a decent selection of games. Might be worth a look if you’re looking for something new. Check it out here: shambhubet

Just a heads up, wk777netlogin seems relatively straightforward for logging in. Process was hassle free. If you are looking for somewhere to login, try wk777netlogin.

Long777, never played there before, but the website name is very catchy! maybe it’s good for a long term entertainment. Worth a try if you are looking for something new. Find out more: long777

Nilfortuneonline, huh? Gotta see if it lives up to the hype. Hoping for some good vibes and even better wins! Join the fun here: nilfortuneonline

Ê mấy ông iOS user, nghe nói có link tải 88vin ngon nghẻ cho iPhone nè. Test thử xem sao nha! Find it here: tai 88vin.link ios

CasinoBetano is good to waste some time. The games work well, and no problems at all on mobile. Give casinobetano a spin to see if it is for you.

CasinoPixbet? Yeah, I’ve seen that one around. The design looks pretty clean. Haven’t deposited yet, but it’s on my list. Worth a look, I reckon casinopixbet.

AfunAPK, easy to download the app, good for folks on Android. I appreciate how you can one-click install it. Try afunapk