Saving money is a cornerstone of financial planning, and blockchain technology is revolutionizing how we think about saving. At the heart of this transformation are smart contracts—self-executing agreements that run on blockchain networks. These digital contracts automate processes, reduce costs, and make saving more efficient and accessible. In this blog, we’ll explore how smart contracts work, their benefits for saving, and how they compare to traditional finance (TradFi) methods.

What Are Smart Contracts?

Smart contracts are computer programs that automatically execute actions when predefined conditions are met. They run on blockchain networks, ensuring transparency, security, and efficiency. For example, a smart contract could automatically transfer funds to a savings account on a specific date or release funds when a savings goal is reached.

Think of smart contracts as digital versions of traditional agreements, but without the need for intermediaries like banks or lawyers. They’re faster, cheaper, and more reliable.

How Smart Contracts Simplify Saving

Smart contracts make saving easier in several ways:

- Automation: Set up a smart contract to automatically transfer a portion of your income into a savings account or investment fund.

- Transparency: All transactions are recorded on the blockchain, so you can track your savings in real time.

- No Middlemen: Save money without relying on banks or financial institutions, reducing fees and delays.

- Custom Goals: Create personalized savings plans with specific conditions, such as saving for a vacation or emergency fund.

Benefits of Using Smart Contracts for Saving

Smart contracts offer unique advantages for savers:

- Efficiency: Automate repetitive tasks like monthly transfers or goal tracking.

- Cost Savings: Eliminate fees charged by banks or third-party services.

- Global Access: Save and manage funds from anywhere in the world.

- Security: Blockchain technology ensures that your savings are protected from fraud or tampering.

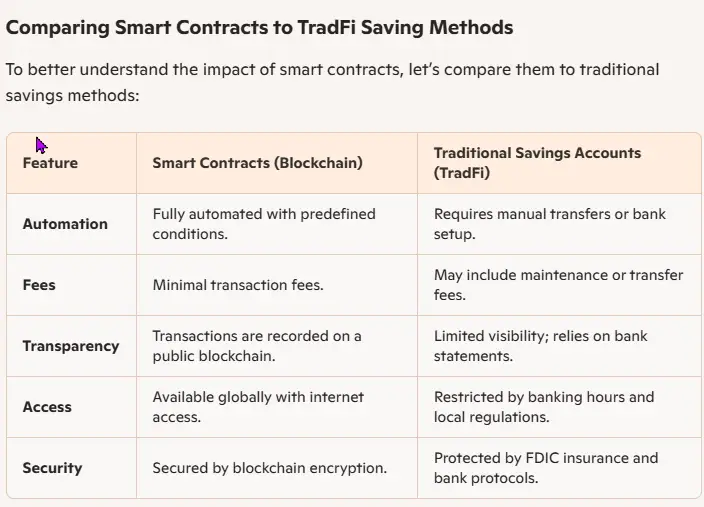

Comparing Smart Contracts to TradFi Saving Methods

To better understand the impact of smart contracts, let’s compare them to traditional savings methods:

| Feature | Smart Contracts (Blockchain) | Traditional Savings Accounts (TradFi) |

|---|---|---|

| Automation | Fully automated with predefined conditions. | Requires manual transfers or bank setup. |

| Fees | Minimal transaction fees. | May include maintenance or transfer fees. |

| Transparency | Transactions are recorded on a public blockchain. | Limited visibility; relies on bank statements. |

| Access | Available globally with internet access. | Restricted by banking hours and local regulations. |

| Security | Secured by blockchain encryption. | Protected by FDIC insurance and bank protocols. |

Real-World Applications of Smart Contracts for Saving

Smart contracts are already being used in innovative ways to help people save:

- Automated Savings Plans: Platforms like Aave and Compound allow users to deposit funds and earn interest automatically.

- Goal-Based Saving: Create smart contracts that release funds only when specific goals are met, such as reaching a savings target.

- Decentralized Finance (DeFi): Use DeFi platforms to earn higher interest rates compared to traditional savings accounts.

Risks to Consider

While smart contracts offer many benefits, they’re not without risks:

- Technical Issues: Bugs in the code can lead to errors or vulnerabilities.

- Volatility: If savings are held in cryptocurrencies, their value can fluctuate.

- Regulatory Uncertainty: Blockchain technology is still evolving, and regulations vary by country.

It’s important to research platforms and understand the risks before using smart contracts for saving.

Similarities to TradFi Saving Methods

Despite their differences, smart contracts share some similarities with traditional savings methods:

- Goal-Oriented: Both help you save for specific purposes, like emergencies or retirement.

- Earning Potential: Just as savings accounts earn interest, smart contracts can generate returns through DeFi platforms.

- Security Focus: Both prioritize protecting your funds, though the methods differ.

Why Smart Contracts Are the Future of Saving

Smart contracts are transforming the way we save by making the process more efficient, transparent, and accessible. As blockchain technology continues to evolve, smart contracts are likely to become a standard tool for financial planning.

Call to Action: Learn More with Web3Wonders

Ready to explore how blockchain can simplify your savings? At Web3Wonders.US, we make complex topics like smart contracts easy to understand. Whether you’re new to blockchain or looking to optimize your savings strategy, our guides and resources are here to help.

Subscribe now to join our community and access exclusive tips, updates, and insights about Web3 and blockchain technology. Start saving smarter with the power of blockchain today!

Disclaimer: The information in this blog is for educational purposes only and does not constitute financial advice. Investing in Traditional Finance and Web 3 assets, including cryptocurrencies and precious metals, involves significant risks, including the potential loss of principal. Always conduct your own research and consult a qualified financial advisor and/or tax advisor before making investment decisions. Past performance is not indicative of future results.

Thinking of giving bonos777bet a try. The name sounds lucky, right? Wish me luck! bonos777bet

jogodotigrinho777 huh? Never seen it. Make a deposit and let us know if it’s good. jogodotigrinho777

Ok, 6777cxgame is next on my list. Wish me luck! I need a win tonight! 6777cxgame

Hey, just checked out bj88ahedu. Always on the lookout for something new. Hope it lives up to the hype! Fingers crossed for a smooth experience. Check them out here: bj88ahedu

77qqslots, slots are my jam! Hoping for some high RTP ones and maybe a jackpot! Let’s spin and see what happens. 77qqslots

Ey yo! Just browsed through x88win. It’s… there. Not particularly impressive, but not awful either. Worth a look if you’re bored. Let me know your thoughts! Check it out here: x88win

Alright, 23winslot, it is an up and coming slot place. There are some kinks to workout. But if you would like to test it then feel free 23winslot